May 18, 2016 | Uncategorized

Join us June 16th 2016 for a Seminar to learn about the implications of the new OT regulations Hosted By: C&A Benefits Group & Business Services, 6135 Memorial Dr., Dublin Registration: 8:00-8:30 Seminar: 8:30-10:00...

May 5, 2016 | C&A Benefits Group, Uncategorized

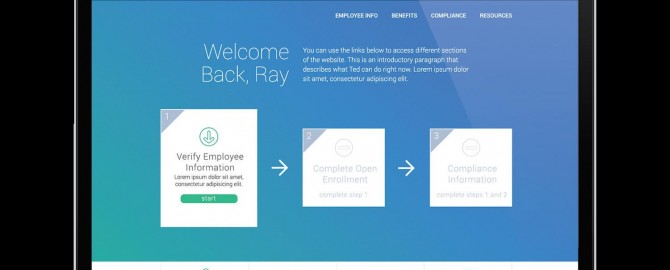

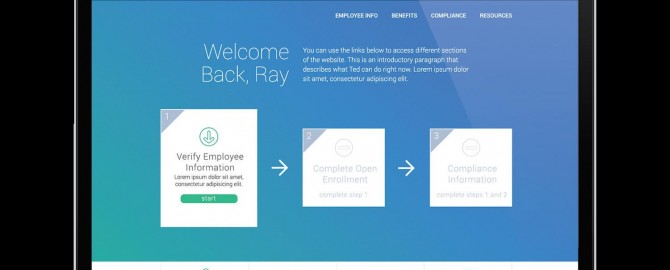

Give new hires an awesome first day, not a stack of paperwork! C&A’s onboarding tools make it easy for you to get new hires up and running without endless amounts of paperwork. We made completing new hire forms painless for employees and HR. There’s no...

Nov 13, 2015 | C&A Benefits Group, health care reform, Uncategorized, Updates

The State of Ohio recently passed House Bill 201 which lowers the age dependents can stay on a parent’s health care plan. Current dependent maximum age is 28. The new age limit is 26. This means those dependents age 26 or older cannot stay covered on a...

Jun 8, 2015 | C&A Benefits Group, C&A Business Services, C&A Payroll Services, HR, Uncategorized, Updates

The IRS has released the 2016 inflation adjusted amounts for health savings accounts (HSAs). To be eligible to contribute to an HSA, an individual must be covered under a high deductible health plan (HDHP) and meet certain other eligibility requirements. Annual...

Sep 24, 2014 | C&A Benefits Group, C&A Business Services, C&A Payroll Services, Clients, Uncategorized, Updates

The Internal Revenue Service has changed the HSA deductible limit for 2015 from $1,250 to $1,300 for self-only coverage and from $2,500 to $2,600 for family and embedded deductible coverage.